18. Result Statement

18. Result Statement

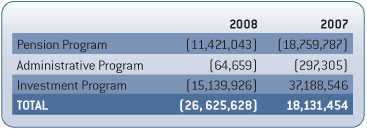

The following chart shows the result’s summarized composition without inter-program transfers:

The result of the fiscal year was negative by R$26,625,628,000 (positive by R$18,131,454,000 in 2007). As a consequence, the accumulated surplus, R$52,937,840,000 in 2007, fell to R$26,312,212,000. The negative profitability of the investments made in Variable Income (24.1%), and the positive profitability in Fixed Income (12.2%), below the actuarial goal of 12.6% (INPC +5.75% per year), contributed to this picture.

The Variable Income segment, with a participation of 57.0% in the investments at the end of the fiscal year, was strongly impacted by the weak performance of Stock Exchange.

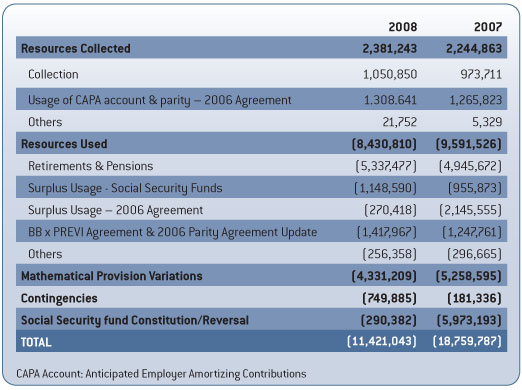

a) Pension Program

The result of the Administrative Program was negative by R$64,659,659,000 (negative by R$297,305,000 in 2007).

To identify the administrative expenses incurred by the common areas, pro rata criteria based on the expenses incurred with personnel assigned to each area (social security and Investment) and on the percentage of the physical area occupied by these activities are used.

The participation percentage of the assets of each plan is applied to the investment’s administrative expenses to calculate the investment’s administrative costing for the Benefit Plans.

By applying the pro rata parameters among the programs, the calculated percentage was 43.0% for investment administration and 57.0% for social security administration.

In the year, administrative expenses reached R$147,740,000 (R$124,553,000 in 2007), 14.1% of the normal social security contributions, 6.1% of the social security administrative expenses, and 8.0% of administrative expenses derived from investments.

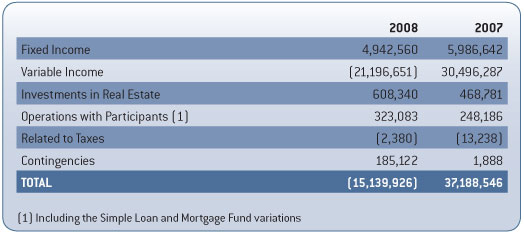

c) Investment Program

This group registers the sales and liquid variations derived from plan resource investments, as follows:

The following events, among others, determine the result attained with Variable Income: (i) negative variation in the stock market (R$21,196,651,000), including income from dividends/interest on equity in the own portfolio (R$1,736,458,000), (ii) net variation in investment funds (R$1,114,070,000), including adjustments made to the economic value of Litel/Vale, 521 Participações, and Neoenergia.

Of the Investment Program’s negative result of R$15,139,926,000, a total of R$15,153,485,000 came from the Pension Program, R$71,869,000 from the Administrative Program and, as administrative costing for the investments, R$85,428,000 were transferred to the Administrative Program.

Sérgio Ricardo Silva Rosa |

Francisco Ferreira Alexandre |

Luiz Felipe Dutra de Sousa |