Analysis of the results attained by the PREVI investment policy

After a five-year cycle of positive results (2003-2007), with excellent annual profitability rates (286.51% in the five-year period) and an expressive surplus accumulation in Plan 1, we were faced, in 2008, with negative profitability (-11%), and with a crisis of global proportions which, among other things, showed the huge difficulties analysis systems face to offer reasonably safe projections for the future.

These two facts, among others, justify a more detailed analysis of PREVI’S situation and the investment strategies that were selected for its Benefit Plans. We will analyze the strategies used for Plano 1, which is composed of riskier assets and of a much larger volume of resources.

Considering the nature of PREVI, it is important for the analysis to go on for a longer period of time, attempting to seize the positive or negative effects of a policy the results of which are only truly relevant in accumulated terms. This does not prevent or disoblige a specific analysis of what happened in 2008, but it is important to keep in mind that the capacity for short-term maneuvering (or resource reallocation) term is very restricted for a Plan of the dimensions of Plano 1, which carries upwards of R$110 billion, or the equivalent of 4.5% of the Brazilian GDP.

Historical figuresBeginning the analysis retrospectively, we will start with a few issues that seem to be the most obvious or important:

- a)does the negative result of 2008 annul the positive results attained in the past?

- b) does the negative result of 2008, caused essentially by the losses incurred in the stock segment, indicate that the allocation strategy used for Plano 1, which in the past few years kept some 60% of the resources in the Variable Income segment, was mistaken?

One of the best ways to answer these questions is by resorting to analyzing historical figures, decomposing and regrouping them in different periods. Although using figures is fundamental (even if they positively justify the choices that were made), it is important to stress that numbers do not say it all.

All decisions that are made are based on hypotheses. The best possible decisions are often made based on the available data, but reality does not always confirm the forecasts.

With that in mind, let’s check the figures out.

Results in different periodsIn order to seek a vision on the efficiency of the investment strategy on the longer term, we have to compare the results attained in different periods to assess the cumulative effect of the options that were adopted.

Considering that the economic conjuncture alternates, at each different moment favoring a different class of assets, in purely mathematical terms the best combination of results would be to have the investments concentrated on the most profitable type of asset in each period. But this would imply in an unlikely capability of correctly forecasting the beginning of a new cycle (such as always being able to sell stock during the high period and buy it in the low one) and in the possibility to making these reallocation movements quickly with significant parts of the portfolio, something that would be impossible to do with a portfolio the size of Plano 1’s.

Therefore, it is reasonable to expect that a given allocation strategy will allow for consistent gains through time, at the average or above the average of the market indices or similar funds. That is what we will try to assess.

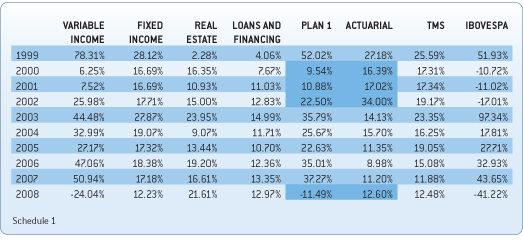

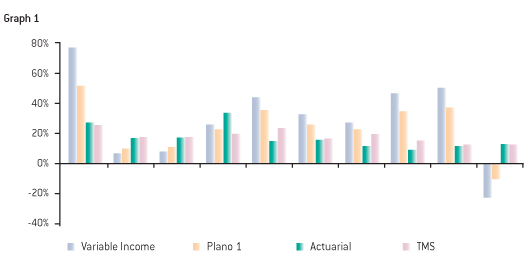

Schedule 1 shows the profitability indices realized in the past 10 years (1999 to 2008), divided in the four segments (Variable Income, Fixed Income, Real Estate, and Operations with Participants). It also shows Plano 1’s accumulated profit, the Actuarial Goal for the fiscal year, and the market indices: TMS (Average Selic Rate) and Ibovespa.

Schedule 1 Profitability – total and per segment – 10-year vision

The schedule highlights the years in which the Plan’s profitability was below the Actuarial Goal, which indicates unsatisfactory investment performance compared to our specific needs to ensure coverage for the pension liabilities.

As can be seen in the table, we have two extremes between the first year (1999) and the last one (2008): the highest and the lowest profitability. But these extremes do not picture each period’s context precisely. In 1999, the strong increase in value occurred after a period of accentuated loss in 1997 and 1998. Between June 1997 and December 1998, the Bovespa Index fell to 6,784 points, down from 12,872. The 1999 performance only represented, therefore, a recovery of these losses.

The 2008 performance, meanwhile, represents the contrary. It is the first time the Stock Exchange fell after five successive years of strong appreciation. The negative performance in the year returns some of the appreciation made in the period.

The two extremes and their respective contexts serve to remind us that the Stock Exchange is a highly volatile, risky environment, with accentuated highs and downs. Therefore, it is a mistake to draw conclusions based on the performance of a single year, as even the choice of certain analysis periods leads to different results. What matters, therefore, is to have a long-term vision and the idea of accumulated results, as we will see further on.

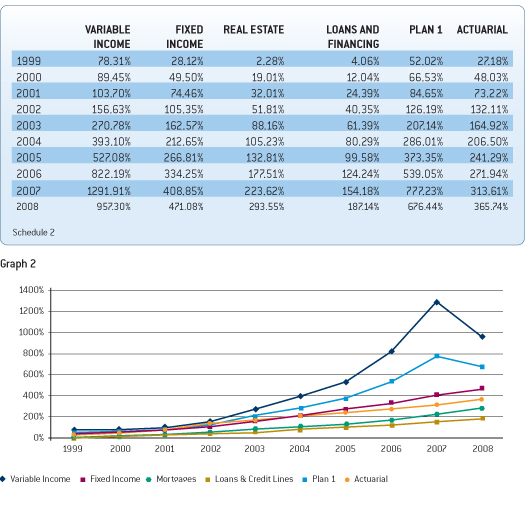

Schedule 2 and the respective graph show the accumulated profitability in each segment in the past 10 years. This allows us to see the cumulative effect of our allocation strategy.

Accumulated profitability

The comparison is strongly favorable for Variable Income. In these 10 years, this segment’s accumulated profitability topped-out at 957.30%, well above that of Fixed Income, and it make a decisive contribution to boost Plano 1’s average profitability.

Naturally, the comparison would be even more favorable if the schedule stopped in 2007, when the accumulated profitability had reached 1,291.91%. But in order for this to have happened, we would have had to “sell” our entire stock portfolio at that time. Even if we had guessed the size of the crisis that ended up materializing, we could not have made more than a small investment reallocation movement, given the volume of our stock portfolio.

Scheduled 2 shows that Plano 1’s accumulated profitability in these 10 years reached 676.44%, well above our actuarial goal for the same period (365.74%). It was by surpassing the expected results that we were able to accumulate surpluses and, thus, to make a series of changes to the Plan at no cost to the members and to the sponsor. Such changes included:

- • Implementation of the contribution parity, in compliance with Constitutional Amendment #20. Parity was implemented with the reduction of the Bank’s contribution, without any cost redistribution to the participants.

- • 40% reduction in the contributions in 2006.

- • Total suspension of contributions in 2007 and 2008.

- • Adoption of a new Actuarial Table, foreseeing enhanced life expectations, increasing the actuarial cost without increasing the contributions.

- • Reduction in the Actuarial Interest Rate, generating a more conservative reserve calculation, foreseeing lower asset profitability without increasing contributions and reducing simple loan and mortgage costs.

- • Reduction of PREVI’S Part, with the consequential increase of benefits, including those that have already been granted.

- • Compensation of the parts the BB owed compared to the Reserves to Amortize for Group 67.

- • Creation of Special Benefits as of 2007: increase in the benefit cap, Proportionality of the PREVI Part, and Certain Income.

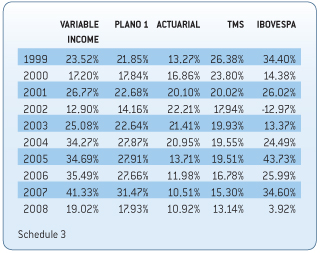

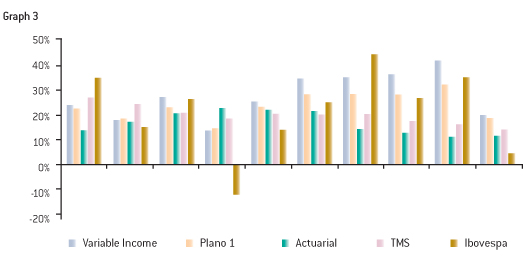

Schedule 3 uses another analysis resource, which is the annualization of the profitability rate based on the rates seen in the last three years. That way, the 1999 index reflects the average of 1997, 1998, and 1999; the 2000 index the average of 1998, 1999 and 2000; so on and so forth.

Based on table 3, it is possible to deduce that the average profitability, in nearly all periods, were above the actuarial one, particularly between 2004 and 2007.

Despite the poor performance in 2008, the average Variable Income profitability accumulated in the past three years (19.02%) is still above the actuarial goal for the same period.

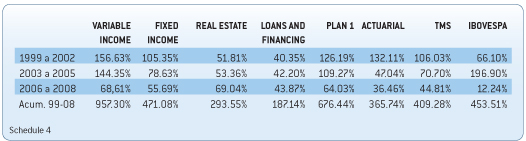

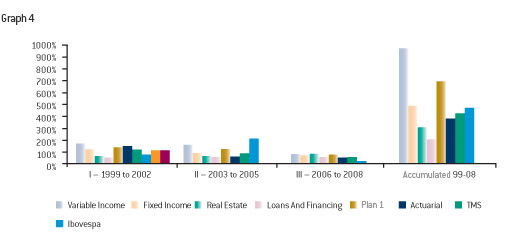

Schedule 4 shows the accumulated profitability in different terms in the past 10 years: I – 1999 to 2002; II – 2003 to 2005; III – 2006 to 2008. It is shown that the Plan’s profitability surpasses the actuarial goal in the periods of 2003 to 2005 and 2006 to 2008. In the case of Variable Income, the profitability is bigger in the three selected periods.

Profitability accumulated in different periods

The numbers show that the Plan’s profitability in the 10-year period surpasses that of the actuarial goal. They also show Variable Income helped push the average upward in spite of the decrease seen in 2008.

If PREVI had opted for a more conservative investment strategy (concentrating its investments on Fixed Income), we would have avoided some negative variation, but our performance would not have been as good as the one we actually achieved.