12. Contingency Liabilities

12. Contingency Liabilities

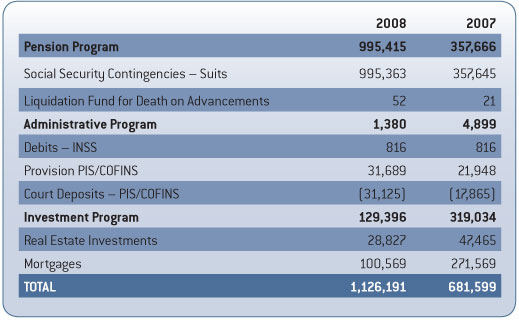

The following chart shows the composition of the contingency provisions per program, which register the occurrence of facts that merit decisions which may or not generate disbursements.

Based on a technical opinion issued by the legal department and observing the indicated risk classification, PREVI prepared a forecast to face the suits filed by participants and former participants.

The variation that was observed, i.e. R$637,718,000, results from the increase in the number of suits in the year and from the constant follow-up on the legal risk attributed to existing suits.

b) Administrative Program A Court Injunction was filed, on 07/13/2006, with a request for a preliminary injunction to guarantee the net and certain right to not submit PREVI to the collection of PIS and COFINS in the fashion required by Law # 9718/1998.The preliminary injunction was granted and a sentence handed down that affirmed PREVI'S requests in part. Based on a legal opinion and considering the favorable court decision, the mentioned contributions have been being deposited judicially since July 2006.

c) Investment Program The reversal of the Real Estate Provision by R$18,638 was due mainly to the transfer of the Extra Barra da Tijuca – RJ property, since in its purchase and sale deed it was agreed that PREVI was not liable for the property taxes.The amounts aimed to regularize the Fundação Umberto I project (R$22,672,000 and the fiscal contingencies related to Edifício São Luiz Gonzaga (R$6,155,000) remain provisioned.

The amount of R$171,000,000 was reversed in the Mortgage provision, as per the measurement made by the technical area, without compromising the reopening of the renegotiations and liquidations by the New Carim.

d) Fiscal ContingenciesSupported by legal opinions that determined it is possible the appeal interposed will be lost and based on the Brazilian and international accounting practices, the exemption of the constitution of a provision for notification by the Brazilian Internal Revenue Service relative to Social Contribution on Net Profit (CSLL) for 1997, for the amount of R$3,108,288,000 (amount of the notification on 03/30/2007), was maintained. See item 4-e of these Notes.