7. Fixed Income

7. Fixed Income

The consolidated movements made in the Fixed Income portfolio, with a variation of R$1,507,176,000, was composed as follows: investments of R$10,514,097,000, divestments of R$13,827,610,000, positive asset variation of R$4,880,373,000, receivables of R$170,038,000 and provision for losses (debenture updates) of R$229,722,000.

Investments made in bonds under the responsibility of the Federal Government in PREVI’S own portfolio were enhanced to R$12,834,829,000 (R$11,609,803,000 in 2007). The resources came from input into PREVI’S cash flow, such as leases, real estate transfers, dividends and variable income asset sales, in the latter case, to contribute to adjusting the percentage of this segment in the limits required by CMN Resolution # 3456/2007. The investments are allocated to LFT (Financial Treasury Bills), bonds indexed based on the Selic rate, NTN-B (National Treasury Bonds – series B), indexed based on the IPCA inflation rate, NTN-C (National Treasury Bonds – series C), indexed based on the IGP-M, NTN-F (National Treasury Bonds – series F), pre-fixed, and LTN (Financial Treasury Bills), also pre-fixed.

Investments made in Financial Institutions include CDBs and Investment Fund quotas, of which 97.7% belong to Benefit Plan 1 and the remaining 2.3% are distributed among the PREVI Futuro Plan and the Savings Portfolio.

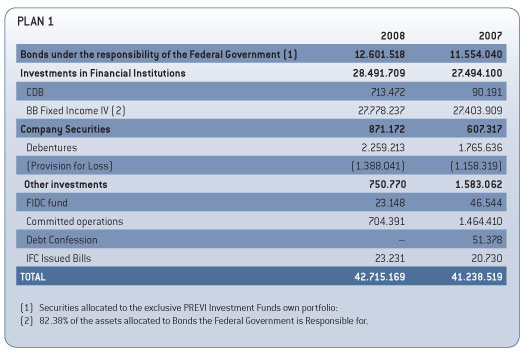

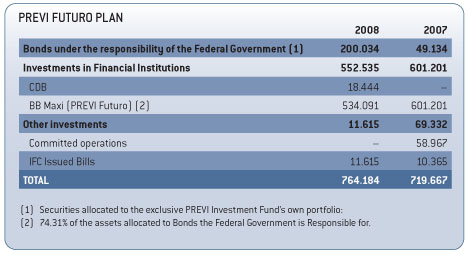

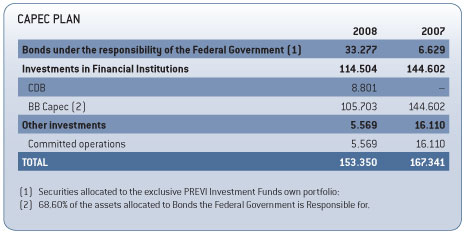

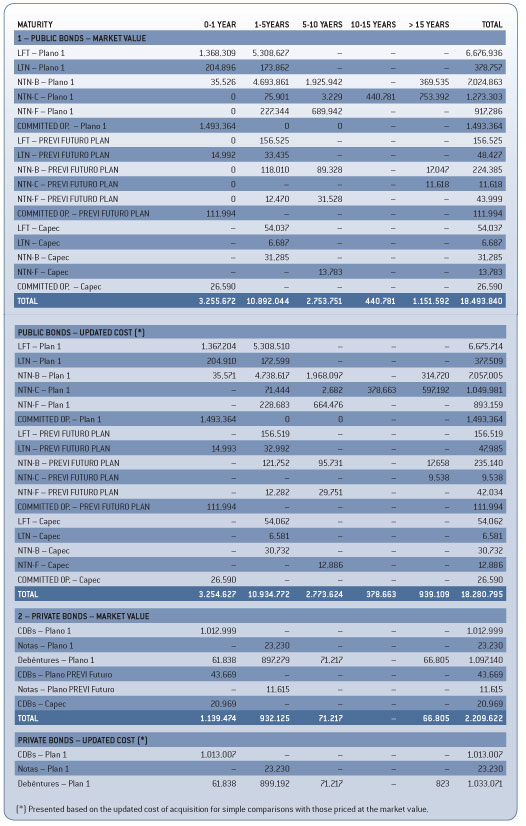

On December 31 2008 and 2007 Fixed Income portfolio is demonstrated as follows per Benefit Plan:

A total volume of R$1,388,041,000 (R$1,158,319,000 in 2007) relative to Embaúba, Invesc, Teka and Hopi Hari debentures acquired in the period of 1984 and 1999, is entered in the provision for loss.

PREVI Futuro Plan’s investment assets increased R$189,784,000, or 20.8%, compared to the previous year, in spite of the negative 2.6% profitability in the period, with 52,384 participants, compared to 45,692 participants in 2007.

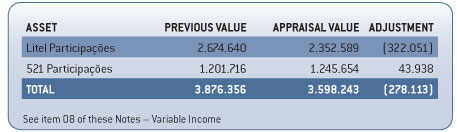

Part of the Litel Participações/Vale and 521

Participações/CPFL/Neoenergia/Itapebi stock, belonging to Plano 1, was acquired in the past by means of the exclusive BB Fixed Income IV investment fund. This stock continues allocated to this Fund, although they represent Variable Income assets. The reappraisal of these assets based on the economic value criterion had a negative impact on the fixed income portfolio of R$278,113,000, as per the following chart:

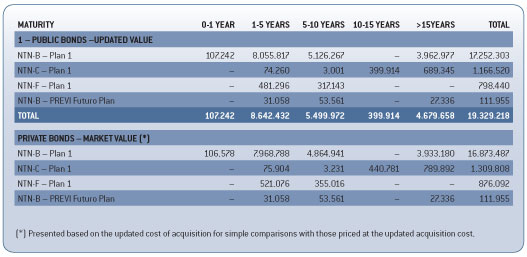

Pursuant to article 8 of CGPC Resolution # 4, of 01/30/2002, the following are the amounts of the own portfolio securities allocated to exclusive Investment Funds, rated as “Securities for Negotiation” and “Securities Kept through Maturity” (per due date range, in years):

a) Securities for Negotiation (includes exclusive Investment Funds)

In the PREVI Futuro Plan, of a total of R$336,340,000, referring to NTN-B, shown in the charts above, R$111,955 were reclassified on 12/31/2008, from the “Securities for Negotiation’ to the “Securities Kept through Maturity” category, in the own portfolio, based on the market price for the following reasons:

-

a) Volatility reduction for the PREVI Futuro Plan quota;

b) Possibility to extend the portfolio’s profile;

c) The investment’s social security nature.

According to item III of article 8 of CGPC Resolution # 4, of 01/30/2002, the reclassification mentioned in the previous paragraph was not reflected in PREVI Futuro Plan’s results.

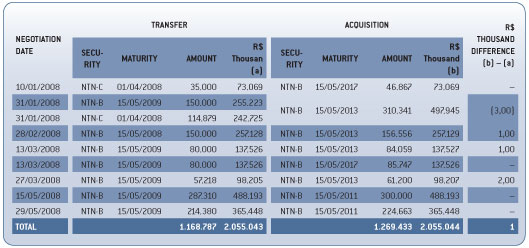

The following are the Federal Public Bonds that were classified in the “Securities Kept through Maturity” category transferred in 2008 (all belonging to Plano 1), as per CGPC Resolution # 15, of 08/23/2005:

Justifications:

a) The transfer operations carried out for federal public bonds, classified in the “Securities Kept through Maturity” category, were done simultaneously to the acquisition of new securities of the same nature, with posterior maturity dates and for a total amount superior to the alienated securities, preserving the Entity’s intention when it classified such securities in the mentioned category;

b) The security rollover operations for securities that had already been accounted for based on the yield curve (subparagraph “a”) were carried out in an exchange auction held by the National Treasury and justified as follows:

- • perspectives of high rates of return with the operation, based on the evolution of the nominal and actual interest rates shown in PREVI’S internal scenarios and in market scenarios;

- • mitigation of the risks of reinvesting the funds in Fixed Income;

- • adjustment of the Federal Public Bonds to PREVI’S long-term cash flow, according to the cash needs pointed out by asset and liability management.

The Entity has the financial capacity and intends to keep these securities through their due dates, as attested to by the Investment, Planning, and Social Security Departments.