8. Variable Income

8. Variable Income

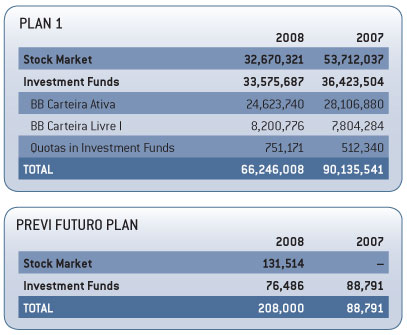

On December 31 2008 and 2007 Variable Income portfolio is demonstrated as follows per Benefit Plan:

The consolidated Variable Income portfolio decrease was R$23,770,324,000, resulting from the following events: investments of R$2,178,891,000, divestments of R$2,971,404,000 (sale of securities from the own portfolio and of those allocated to investment funds, redemptions and amortizations from investment funds) and a negative asset variation of R$22,977,811,000.

a) Stock MarketPlan 1 cash market includes securities of several companies. Among those with the biggest financial volume are: Petrobras, Banco do Brasil, Itaubanco, Ambev, Bradesco, Neoenergia, Embraer, Vale, Usiminas, Itausa, and Perdigão.

The following stock stands out in the PREVI Futuro Plan: Petrobras, Bradespar, Vale, Itaubanco, and Bradesco. The total of R$18,979,000 has been entered as a provision for loss. This total is for the accounting value of stock of companies that have entered into a composition with creditors, that are going through bankruptcy or for stock that is considered difficult to receive (Banco Econômico, Casa Anglo, Banco Nacional, and Gazeta Mercantil), acquired in the period ranging from 1991 to 1998.

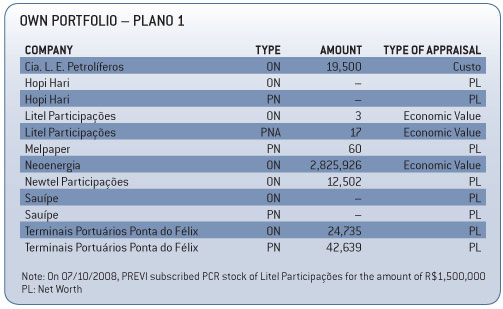

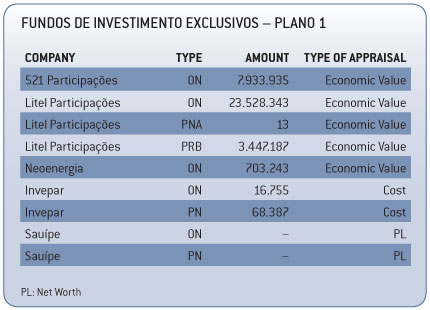

b) Investment Funds – Plano 1The stock of Litel Participações, a specific purpose corporation (SPC) which holds stakes in Valepar, the controller of Vale, are entered in the exclusive BB Carteira Ativa fund and in PREVI’S own portfolio. Since Litel’s stock is not traded in the market (although indirectly they represent Vale stock), these stakes have been being appraised based on the economic value criterion since 2002.

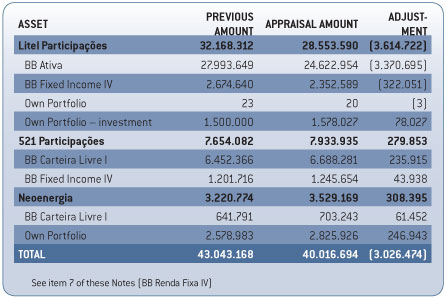

The value of PREVI’S participation in Litel was reduced from R$30,668,312,0000 in 2007, to R$28,553,590,000, in 2008, on account of the economic reappraisal made in 2008. Part of this amount is allocated to the BB Renda Fixa IV Fund (R$2,352,589,000), as per Note 7.

Stock belonging to 521 Participações (a specific purpose corporation that holds stakes in power sector companies such as CPFL, Neoenergia and Itapebi) and Neoenergia are allocated to the exclusive BB Carteira Livre I Investment Fund and account for 90.1% of the Fund’s assets.

In 2008, 521 Participações (R$7,933,935,000) and Neoenergia (R$3,529,169,000) were also priced at the economic value. Part of the value of 512 Participações is allocated to the BB Renda Fixa IV exclusive fund (R$1,245,654,000); while part of Neoenergia's value is in PREVI'S own portfolio (R$2,825,926,000).