4. Savings Fund - CAPEC

4.1 Database

4. Savings Fund - CAPEC

4.1 Database

4.1.1 Capec’s database for actuarial appraisal is of October 2008, and is composed of 165,323 participants distributed in the guaranteed savings, as per Schedule M:

4.2.1 Capec is registered at the Office of Supplemental Pension Plans as a single payment benefit plan and offers the following savings:

4.2.2 For dependents or assigned beneficiaries:

• Savings for Death: as a result of the participant’s natural or accidental death, as per the mode of adhesion.

• Subsistence Savings: if the participant dies before the Spouse Savings proponent does, the latter may continue connected to the Capec, by joining the Subsistence Savings plan, taking-on the maintainer status and the commitment to continue paying the contributions PREVI indicates, as per the mode of adhesion.

4.2.3 For participants:

• Savings for Disability: as a result of labor disability which has occurred and as per the adhesion mode.

• Spouse Savings: as a result of the death of the wife or husband or of the companion, acknowledged as such under the civil law, as long as properly registered in the Economic Dependent Reference file of the Banco do Brasil S.A., PREVI or of the Official Social Security System as a companion, as per the mode of adhesion.

4.2.4 Capec is foreseen in art. 3, Subparagraph IV, of the Entity’s Bylaws, which ensures “to all participants: the option of being connected to a savings plan by means of making specific contributions,” therefore, Capec is maintained with participant contributions and there is no employer contribution. Its financial system is that of simple distribution with annual accrual periods.

4.3 Calculation methodology and actuarial premises4.3.1 Capec’s revenue is calculated based on the Simple Distribution Financial System with annual actuarial appraisals, based on an ordinary actuarial calculation principle used for the technical constitution of temporary life insurance for a year with automatic annual renewals.

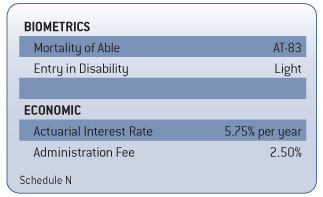

4.3.2 The premises used in the December 2008 actuarial reappraisal for the 2009 fiscal year were approved by the Executive Board and by the Deliberative Body. The approved premises were:

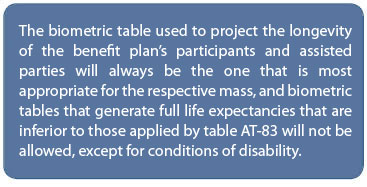

4.3.3 To calculate the pure premiums, the AT-83 mortality table was used, to substitute for the GAM-71 table which was used until them, recommended by SPC Inspection Report # 21/ESRJ, of June 9 2008, which seeks to adjust the Capec to CGPG Resolution # 18, of March 28 2006, item 2, transcribed as follows:

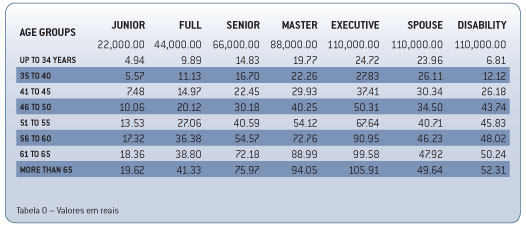

4.4.1 Schedule O shows the monthly premiums in effect that correspond to the amounts insured by Capec, considering the administration fee of 2.5% and the 10% contingency fee:

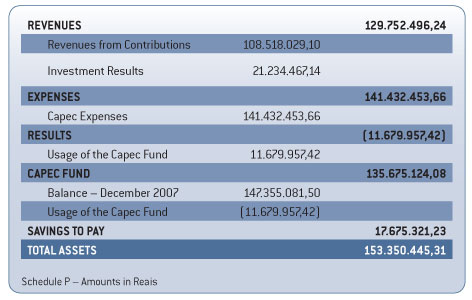

4.4.2 The flow of contributions, from paid claims and gains with investments relative to the portfolio had the following results on 12/31/2008:

4.4.3 Capec’s Social Security Fund, called Capec Fund, was constituted to ensure the payment of savings when there are insufficient availabilities. On 12/31/2008, the balance of the Capec Fund was R$135,675,124.08.

4.4.4 During the year, R$11,679,957.42 of the mentioned Fund’s resources were used to subsidy contributions made by older participants in the transition from the collection via sole premiums to a collection per age group, which began in 2006. This measure was part of Capec’s Restructuring Plan, as approved in 2005 by the Executive Board and by the Deliberative Body.

4.4.5 Because of this, the Capec’s total assets were reduced from R$167,350,927.58 (12/31/2007) to R$153,350,445.31 (12/31/2008).

4.4.6 We also entered the amount of R$17,675,321.23 for the provision of informed and unpaid claims by the portfolio corresponding to processes in course of liquidation.

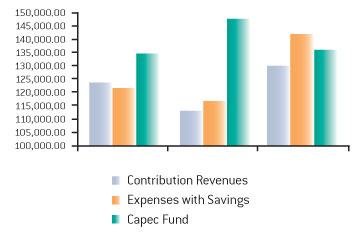

4.4.7 The following is the evolution of the contribution’s revenues, expenses with savings, and of the Capec Fund’s amounts in the past three years:

4.5.1 New members

4.5.1.1 In 2008, PREVI maintained the Capec’s fund raising plan for the adhesion of new participants. In this period, 2325 participants joined the plan, 77% of whom aged up to 40 years.

4.5.1.2 The arrival of new participants is fundamental for Capec, since the participants’ current average age is 56 years. This rejuvenates the portfolio and helps reduce the plan’s biometric risks.

4.6 Conclusion4.6.1 The contribution amounts calculated for the Savings Portfolio and the expected evolution for the commitments the plan took-on with its participants show that the actuarially premises were defined appropriately in the period under analysis.

4.6.2 Considering the above, we conclude the results attained by the Capec at the closing of the 2008 fiscal year indicate it is actuarially balanced.

Rio de Janeiro, February 5 2009.

Cleide Barbosa da Rocha

Actuary – MIBA 732

Dilcrécio Akira Miki

Actuary – MIBA 1.959