4. Social Security

4.1 Plano 1: the CGPC approves Resolution # 26On September 29, the Supplemental Pension Plan Management Council (CGPC), the agency that is in charge of regulating the sector, approved Resolution #26. The rule “provides regarding the conditions and procedures the closed supplemental pension fund entities must observe when calculating their results, allocating and using their surplus, and equating the deficit of the pension benefits plans they administer (…).”

The new provisions include the adoption of the AT-2000 Mortality Table and the 5% actuarial interest rate if a decision is made regarding the destination of the surplus. The Resolution also calls for discounting from the surplus the part of the funds’ investments which is not under National Monetary Council (CMN) Resolution # 3456.

PREVI sent an extensive list of questions to the Office of Supplemental Pension Plans (SPC) and is still waiting for answers for them. Suits contesting aspects of the Resolution must also be mentioned.

4.2 Debates regarding the 2007 surplus of Plano 1 have been suspendedIn the addition to the need to make a detailed analysis of Resolution # 26, the current economic conjuncture caused the debates on the usage of the 2007 surplus of Plano 1 to be suspended given the impact the Variable Income quotes had on the reserves.

4.3 Plano 1 contribution collection suspension maintainedThe collection of the contributions for Plano 1 remained suspended in 2008, a fact that represented real gains for the members.

4.4 Plano 1: special benefits paid in the yearSpecial benefits derived from the usage of the surplus accumulated in 2006 were implemented in January 2008. A total of R$445.56 million were paid relative to these benefits in the year.

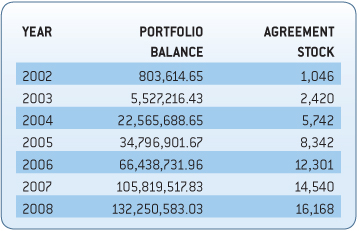

4.5 PREVI Futuro celebrates its 10th anniversaryPREVI’S variable contribution plan celebrated its 10th anniversary in 2008. In ten years, it ranks alone among Brazil's top 60 pension funds*. Robust, PREVI Futuro has assets worth more than R$1 billion and more members than the total active participants of Plano 1.

4.6 PREVI Futuro surpasses the 50,000-participant markWith the entry of 7,210 members in 2008, PREVI Futuro surpassed the 50,000-participant mark. Supported by the Gepes (the Banco do Brasil’s Regional Staff Management Department) from all over the country, approximately 89.34% of all new employees joined the PREVI Futuro plan this year. According to the balance accumulated since the beginning of the Plan, the states with the most members are: Rio de Janeiro (95.0%), Rio Grande do Norte (94.7%), Minas Gerais (94.5%), and Espírito Santo (93.9%).

PREVI Futuro is a young plan, not only in terms of its period of existence, but also of the public that composes it. Of the 52,637 participants, some 65% are aged up to 34 years.

4.7 Capec: new schedule allows participants more savingsAs of April, the Savings Fund (Capec) adopted a new coverage amount schedule. Contributions for the death plans were either reduced or maintained. An average reduction of 54% was also made to the contribution amounts for the Disability savings and, for the second year in a row, the Spouse savings contribution values were maintained. These measures were based on new technical and actuarial studies.

4.7.1 Promotions boost adhesionsThe Capec welcomed 2,410 new participants aboard in 2008. The year started with the “Go to the Costa do Sauípe with Capec” campaign, which raffled off 10 trip packages with companions and closed the “Capec and You” campaign, in which all of those who enrolled were given a small gift. After this campaign, 1,312 participants joined the Capec.

The campaign successfully attracted younger participants aiming to revitalize the Capec and ensure its perpetuation.

4.8 Simple Loan 4.8.1 Fee reductionThe administration fee for the Simple Loan was reduced to 0.2%, down from 0.5%, on the gross amount of the loan for operations contracted as of 07/02 by participants of both plans. The measure resulted in the reduction of the costs for the operations, compensated for the increase made to the IOF tax, and benefited borrowers with the increase in the resources available to them.

4.8.2 Plano 1: enhanced ceilingOn 09/30, the Executive Board approved the enhancement of concession ceiling for the ES Series 10, 12 and ES Finibob modes from R$35,000 to R$50,000 with a grace period of 12 paid installments for renewal. The new conditions went into effect on December 15. Between December 17 and 31, 9,979 operations were carried out, totaling a net financial volume of R$168 million. In 2008, 41,810 participants contracted 62,435 Simple Loan operations. The year was wrapped-up with 60,754 Simple Loan operations, involving a total of R$1.482 billion.

4.8.3 PREVI Futuro: loans temporarily suspendedThe Simple Loan operations for PREVI Futuro participants were temporarily suspended on 10/22*.

The loan operations reached the ceiling imposed by the legislation – CMN resolution # 3456, of 06/01/2007 – which determines pension funds cap the usage of the Plan’s guarantee resources for operations with participants at 15%. Operations with participants are understood as Simple Loan and Mortgage grants to members of the Plan itself. The legal cap is established based on the sum of these two categories of operations.

* The Simple Loan operations for PREVI Futuro participants were resumed on 02/16/2009.

With the opening of real estate financing (Carim) to PREVI Futuro, the Plan’s guarantee resources went on to be distributed at the rate of 14% for Simple Loan operations, and 1% for Real Estate Financing operations.

When the cap set for Simple Loans was reached, the operations had to be temporarily suspended, at no prejudice to the Plan’s Real Estate Financing operations.

* The Simple Loan operations for PREVI Futuro participants were resumed on 02/16/2009.

4.9 Carim 4.9.1 FGTS to liquidate mortgagesPREVI renewed, through July 2010, the agreement it has with the Caixa Econômica Federal that allows the usage of the FGTS (the employees’ severance guarantee fund) to liquidate mortgages. Since the agreement was signed, in 2005, a total of 1,653 agreements have been liquidated, involving a financial liquidation volume of R$100.422 million. In 2008, 68 agreements were liquidated, for a total of R$3.868 million.

In 2006, 1,166 agreements were liquidated with own resources, for a total of R$54.291 million.

The mortgage guarantee replacement process was restructured, services rendered to the participants were improved and operation safety increased.

4.9.2 Plano 1: approximately 8,000 summoned at CarimAll of the 7,967 participants of Plano 1 who showed interest in financing through the website’s self-service feature or via the 0800-729-0505 toll-free customer service center were summoned. A total of 2,518 credit lines have already been granted since the portfolio reopened, in December 2006.

Of this total, 1,895 agreements were signed in 2008 and moved some R$230 million. All of those who showed interest in financing received the summons letter.

4.9.3 Opening of the real estate portfolio to the PREVI FuturoThe Mortgage Portfolio (Carim) was opened to PREVI Futuro participants in August. In 2008, 32 participants who had fulfilled all pre-requisites – 10 full years as members of PREVI Futuro and consignable margin availability – and made their interest in mortgages were summoned. The first summons was made in September, and the first agreement signed in December.

The Board destined 1% of PREVI Futuro’s guarantee resources to operations of this sort. The Carim allows one to finance up to 100% of the value of the property in up to 240 months. Homes, new or used, made out of bricks, in good state of conservation, located in urban regions, with completed construction work, duly registered at the Real Estate Notary, with proper documentation, without obligations or real onus, can be financed. The complete regulation is available at previ.com.br.

4.10 More than 4 million customer service eventsIn 2008, PREVI provided 4,174,000 customer assistance services. Of this total, 3,618,000 were made through the site’s self-service feature; 350,813 over the telephone; 134,103 via the Customer Service self-service (ARU – Audio Response Unit) at 0800-720-0505; 61,179 were messages were sent through the mail, via Contact us (e-mail) and over the Sisbb; and 9,383 were presence customer service events provided at PREVI’S main office building.

4.11 Income simulatorAvailable at PREVI’S website since October, the new version of the income simulator allows PREVI Futuro participants to calculate the benefits with reversal in pensions beginning at an age above the minimum one required for retirement. The novelty came as a response to participant requests.

The simulator allows future benefits to be estimated in three different modes: based on the projected basic monthly gross income; on the desired gross income; or on the desired contribution on the participation wage.

In all modes, it is also possible to change the income rate, which is the estimated yield rate applied to personal and employer reserves, from the calculation date through the date informed in the Desired Retirement Age field.

This tool allows the participant to plan additional investments to guarantee the desired benefit levels. The tool can be accessed through the self-service feature at the PREVI website, under New Calculation.

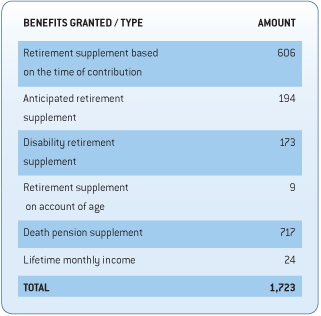

4.12 Granting benefitsIn 2008, 1,699 retirement and pension supplements and 24 lifelong monthly incomes were granted. The latter is paid to those who leave BB before being entitled to retirement, but maintain their reserves at PREVI and opt to no longer contribute. After retiring through the INSS, they are entitled to the lifelong monthly income.

As of 2009, participants will be able to follow-up more closely on how their resources are invested. This is because of the roll-out of the Investment Profiles, which will offer different types of risk, with different investment distributions between Fixed and Variable Income.

The amount of the benefit the person will receive when he/she retires will be directly influenced by the profile he/she picks, i.e., two participants, with the same membership time and equal contribution values may have different benefits on account of the profitability of the investments that are inherent to the selected profile.

Because of this, alternating between profiles will require the participant to follow-up on the market, on portfolio profitability, on their reserve balance, and the participants must always keep in mind that this is a long-term investment with greater or smaller degrees of risk, depending on the participant’s choice.

Information is the best tool when it comes time to opt for a profile. PREVI will make content available in all means of communication to help participants pick investment profiles sensibly. It is possible to offer investment profile options because PREVI Futuro is similar to a Defined Contribution (DC) in the part dedicated to accumulate reserves for retirement, in which the account balances are individualized. The lifelong benefit to be paid is calculated based on the total accumulated amount and on actuarial premises.