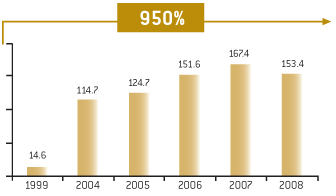

Evolution of the asset

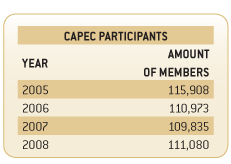

In the past 10 years, the Capec registered an accumulated increase in assets in the order of 950%, which was the fruit of the increase in the number of participants and in investment profitability.

Evolution of the assets (R$ million)

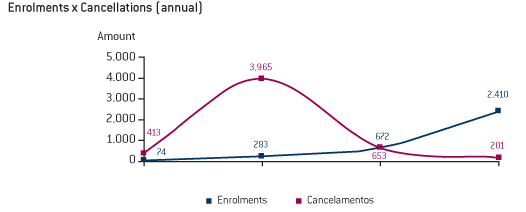

During the year, the Capec was joined by 2,410 participants, who are convinced of the importance of counting on the security offered by the Savings Fund and with a rather advantageous cost/benefit ratio.

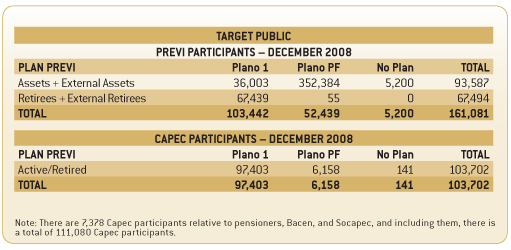

Total Capec participants

Campaigns and promotions helped Capec enroll an expressive amount of new participants, and led to a significant increase in the registrations for disability and spouse savings and to a reduction in the number of cancellations. Of the upwards of 111,000 participants, only 201 requested cancellation in 2008, while 2,410 employees joined the Capec.

The first promotional campaign awarded 10 participants with trips to Costa do Sauípe. It was followed by smaller promotions which were segmented per public. The “Capec and You” Campaign was held in late 2008. Through it, anyone who signed up would get a free prize.

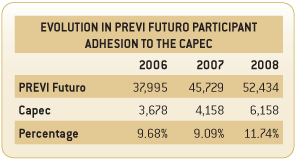

PREVI has worked hard on enrolling PREVI Futuro participants in the Capec. This measure affords the Plan the chance to reduce the members’ age group and to offer a rather attractive pension product, one which attends to everyone with higher savings amounts and lower costs. This effort has been successful, as the following schedule shows:

In 2008, 59% of the new participants were aged up to 34 years and concentrated mainly on the Junior (26%) and Executive (31%) plans. This rejuvenation in the savings portfolio shows young people have become aware of pension and financial education. By planning, they are in pursuit of ensuring a better future.

The Capec Plan is based on a simple distribution system, i.e., contribution amounts are reviewed annually to compose a reserve that is common to the group to ensure the payment of the sums during the year.

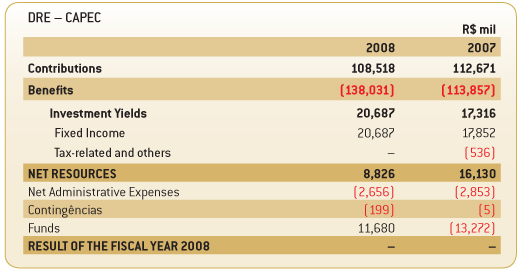

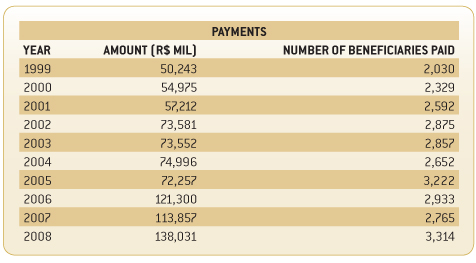

In 2008, Capec paid out R$138 million to 3,314 beneficiaries.

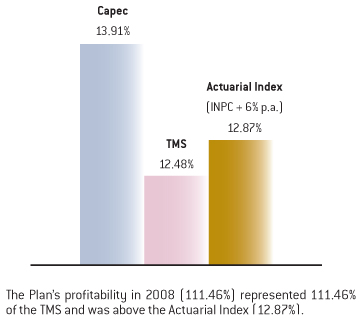

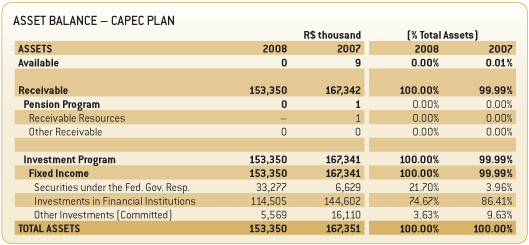

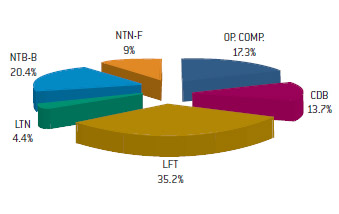

Capec’s profitability is different from that of other plans because, according to its Investment Policy, the investments concentrate on Fixed Income. The segment’s composition emphasizes less volatile securities which have performances that are closer to the average Selic Rate (TMS), which was up throughout the year. The investments are made by and large in LFT, highly liquid securities with short-term due dates.

Capec Fixed Income

Plan Capec - Compared Profitability