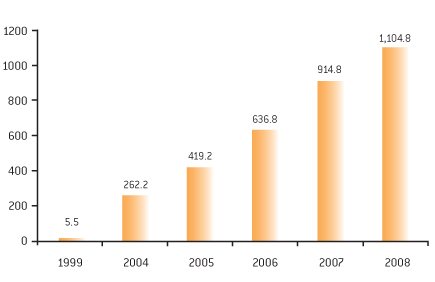

More than R$1 billion in assets in the Plan’s 10 years of existence

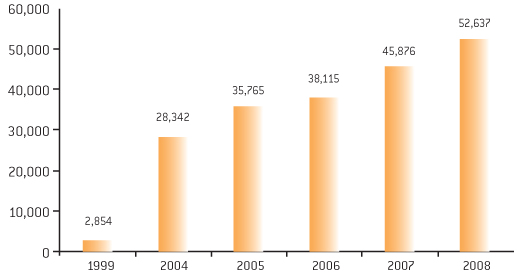

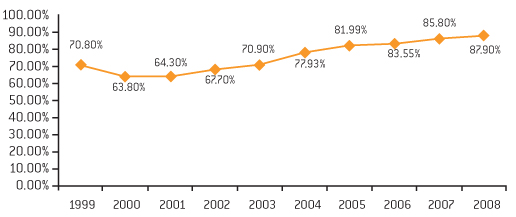

PREVI’S youngest Plan celebrated its 10th anniversary in 2008. With an accumulated adhesion rate of 87.90%, it closed the year with more than 52,000 participants and assets worth more than R$1 billion.

The continuity of the partnership with the Banco do Brasil’s Staff Management Departments (Gepes) was essential to increase the number of adhesions in the last fiscal year. The partnership derives from an agreement signed between PREVI and BB, through which PREVI Futuro and the Savings Fund (Capec) are introduced to all employees hired by the Banco do Brasil. At the height of the hiring at BB, the adhesion rate in the year was 89.34%.

Evolution of the number of participants since the creation of the Plan

Evolution in the accumulated rate of adhesion compared to the total number of employees after 1997

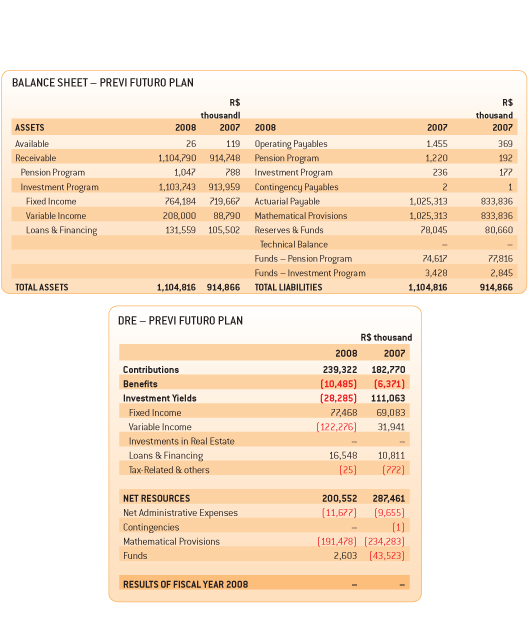

The plan closed the year with assets worth R$1.104 billion, enough to rank it, based on the asset criterion, among the top 60 Brazilian pension funds.

Evolution of the PREVI Futuro assets (R$ million)

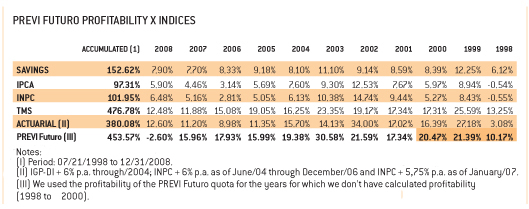

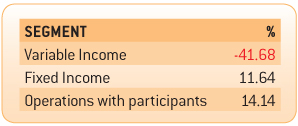

The Plan’s Investment Program’s profitability closed the year negative in 2008, at -2.6%. The result was directly influenced by the performance of the stock portfolio, impacted by a strong downward trend.

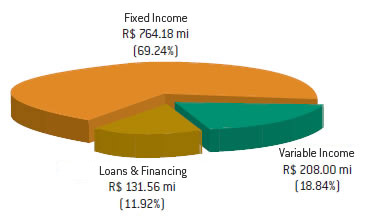

In late 2008, PREVI Futuro’s investments were distributed as follows: 69.24% in Fixed Income; 18.84% in Variable Income; and 11.92% in Loans & Financing to participants.

PREVI Futuro Asset Distribution

In terms of accumulated profitability since its beginning, the Plan accumulates 453.57%, surpassing the actuarial goal for the same period, which was 380.08%. Up to 2007, the accumulated profitability, of 468.35%, surpassed the Average Selic Rate (TMS), of 412.78%. In 2008, the performance was affected by the investments made in Variable Income, with a significant decrease in the Stock Exchange.

Until 2006, the Plan had its resources invested only in the Fixed Income and Loan & Financing for Participants segments. Considering the Plan’s increase in assets, the need to diversify investment allocation and the search for greater profitability, a decision was made to allocate part of the resources to Variable Income. The first investments in this segment were made in October 2006. The fact the Plan is young and that its participants will have a lot of accumulation time was also kept in mind, and this allows a little more risk to be taken in search of greater return, counting on the long term as a mitigating element for any variations that may occur from year to year.

In 2007, for example, the plan had 9.71% of its total investments made in Variable Income, the yield of which was 53%, and this allowed 3.65 percentage points to be added to the Plan’s overall profitability. On account of the positive expectations, the decision to increase exposure in shares to 30% of the total investments was made in late 2007.

From January to May 2008, the Plan increased its investments in Variable Income, topping-out at 27.62% of the allocation in the segment. As of May, the value losses led this percentage to be reduced to 18.84% in December.

The investment policy for PREVI Futuro maintains the 30% allocation goal for Variable Income. This goal may be reassessed based on the participants’ options for investment profiles, a measure to be deployed in 2009.

1. Segment profitability/2008

1.1 Variable Income

The profitability of the Variable Income segment closed 2008 with a negative performance of -41.68%, slightly better than that of the Stock Exchange itself, the IBrX-50 index of which accumulated losses of -43.14%. This performance, which was a little better than that of the market, derived, in part, from the purchase and sale strategy developed particularly in the Stock Exchange’s most volatile period.

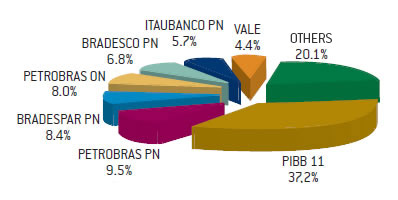

Segment composition (Dec/08)

The PREVI Futuro Plan started investing in Variable Income in October 2006. A decision was then made to invest in PIBB, a fund that keeps pace with the performance of the IBrX-50, with a same Investment Policy goal. As of February 2008, the investments were diversified with the acquisition of other assets.

Most PREVI Futuro participants are still far from retirement. The number of retirees will only start increasing a lot in 15 years. Therefore, the Plan is in its full capitalization phase. The poor results of Variable Income in 2008 must therefore be analyzed from the long-term perspective. There will be time for the securities, which are now being diversified, to recover their market value. This fact, however, did not keep PREVI from making strategic share purchase and sale movements, seizing favorable moments.

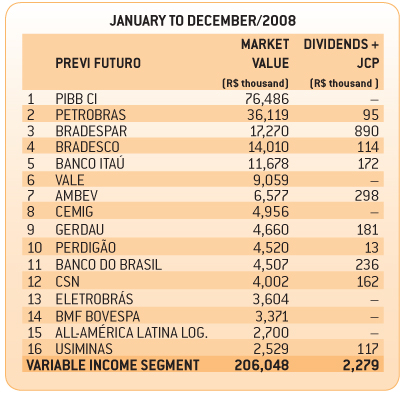

Variable Income – Main Interests

Total dividends: R$2,279,325

This was the first year the Plan received dividends from the investments made in stock. The entrance of these resources was another factor that contributed to sooth the negative variation of the investments’ market value. Had the dividends not entered, the negative profitability would have been -44.48%, instead of -41.68%.

Resources coming from the dividends are incorporated directly into the Plan’s results and to the participants’ quotas, with positive impact on them.

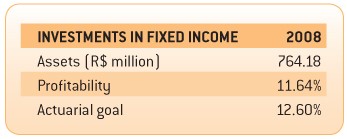

1.2 Fixed IncomeThe segment’s accumulated profitability was 11.64%. The portfolio’s profitability was below the actuarial goal of 12.60% and was influenced by the economic scenario, which had an impact on Fixed Income security pricing, particularly those with longer maturities and pre-determined rates.

Keeping what happened in 2008 in mind, through September, the main concern among the monetary authorities was increased inflation, a fact that caused the raise in the Basic Interest Rate. In this scenario, securities with pre-determined rates depreciated. Since all PREVI Futuro plan securities were entered in the “marked-to-market” category, the amount entered in our books was adjusted to the prices practiced for similar securities in the market. The value of these securities started going up in the end of the year, when it became clear the Central Bank was going to interrupt the interest rate increase trend.

To keep market volatility from transferring into our Fixed Income security portfolio, a decision was made to transfer a part of these securities to the “kept through maturity” category, a move that started being made as of December 2008. That way, the securities PREVI intends to keep through maturity will be accounted based on the acquisition value plus the variation according to the contracted correction rate.

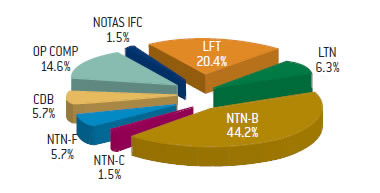

The NTN-B (a security indexed based on the IPCA + interest rate) is the main asset in the PREVI Futuro Plan’s public security portfolio, as illustrated by the following graph. These securities have more extended maturity periods and a pre-determined interest rate.

Fixed Income portfolio profile

PPFuturo – Asset Allocation – Dec/08

The segment’s profitability was 14.14% above the actuarial goal of 12.60%. The minimum the law requires is INPC + 5.75%. The difference between profitability and the actuarial goal derived from the fact that PREVI updates the outstanding balances based on the INPC of the previous two months.

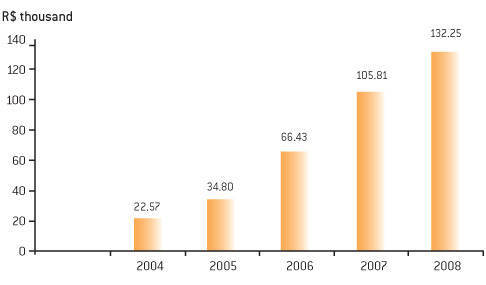

Simple Loans started being granted in 2001. The portfolio currently has 16,168 agreements, worth R$132.250 million.

In 2008, the participants started having access to mortgages (Carim). The first contract, worth R$80,000, was signed in December.

Volume of resources contracted under Loans & Financing