9. Investments in Real Estate

9. Investments in Real Estate

Assets in this segment totaled R$3,251,747,000 (R$2,936,859,000 in 2007), distributed as per the demonstrative chart for item 6 of these Notes, belonging solely to Plano 1.

CMN Resolution # 3456, of 06/01/2007, determines that Real Estate must be reappraised at least once every three years.

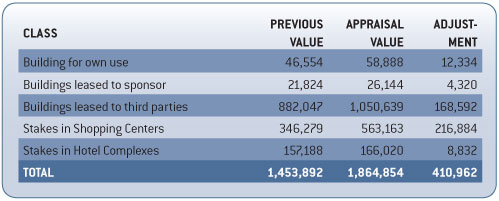

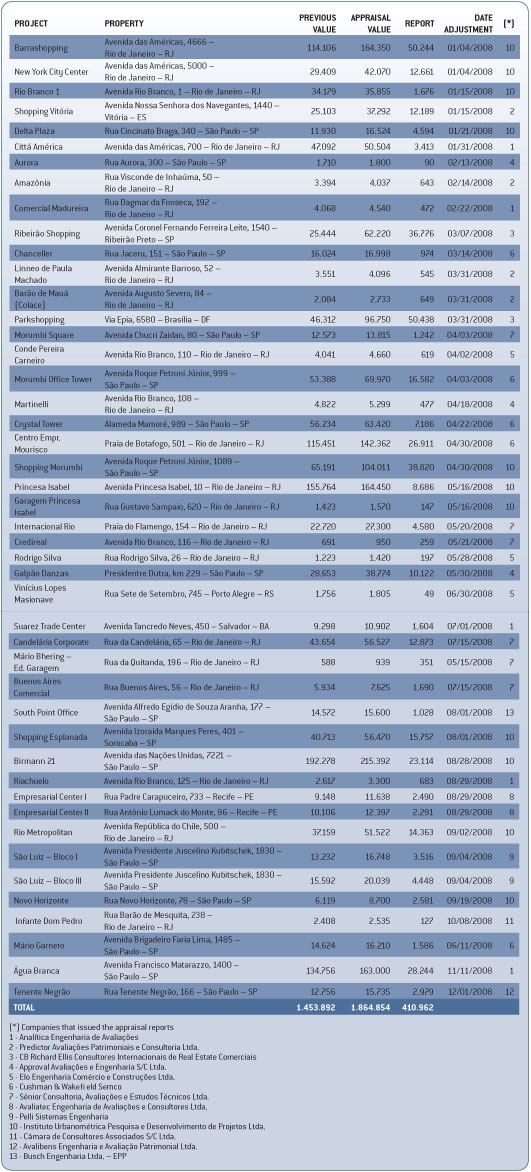

Of the 75 properties that compose PREVI’S portfolio, 46 were reappraised in 2008 based on reports issued by independent companies, generating a positive asset variation for the portfolio of R$410,962,000, as per the following charts:

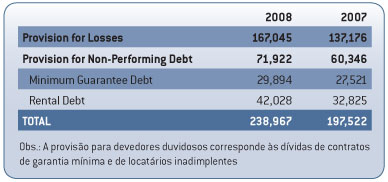

The provisions for losses and non-performing loans in this segment added up to 238,967,000 (R$197,522,000 in 2007), as per the following chart:

The provision for loss relative to advancements to be recovered from Fundação Umberto I was reinforced by R$26,460,000, to a total of R$144,265,000 (R$117,805,000 in 2007).

The provision for losses corresponding to the ordinary suit for the rescission of the purchase and sale promise deeds for the 7th floor and for the technical floor of the Centro Empresarial Mourisco was updated by R$3,409,000, to R$22,780,000, in this fiscal year (R$19,371,000 in 2007).