3. PREVI Futuro Benefit Plan

3.1 Database

3. PREVI Futuro Benefit Plan

3.1 Database

3.1.1 PREVI has its own reference file for participants in the PREVI Futuro Benefit Plan, which is integrated to the Entity’s other information systems. To compose this reference file, we receive financial and non-financial information (personal and functional data) from the Banco do Brasil and from the available database.The data are treated carefully, and submitted to consistency and reliability filters.

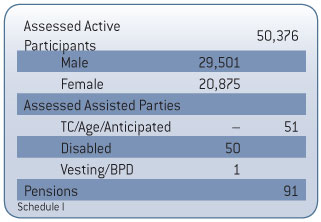

3.1.2 The reference file database that is used for the actuarial appraisal of Benefit Plan 1 dates to December 2008. The reference file’s summary presents the following numbers regarding active participants, assisted participants and pensioners:

3.2.1 On account of CGPC Resolution # 16, of 11/22/2005, and of SPC Normative Instruction # 9, of 01/17/2006, the PREVI Futuro Benefit Plan is defined as one of Variable Contribution, and is composed of Part 1, outlined in the defined benefit mode, including the following benefits as set forth by the Regulation:

-

• Retirement supplement for disability;

• Pension supplement for death.

3.2.2 Part II, outlined in the variable contribution mode, presents the following benefits as set forth by the Regulation:

-

• Monthly Retirement Income;

-

• Anticipated Monthly Retirement Income;

• Monthly Pension Income for Death.

3.3.1 The PREVI Futuro Benefit Plan is appraised based on the capitalization system for all installment-based payment benefits that are scheduled and continuous. Normal and anticipated retirements are included in this type.

3.3.2 The aggregated method was used to calculate the disability and pension for death charges for Part I. The principle of asset financial accumulation is used for the generation of the monthly retirement income or the anticipated monthly retirement income.

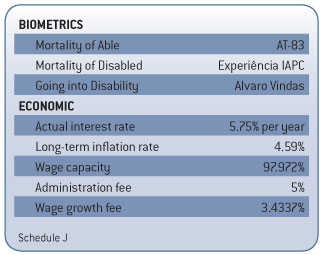

3.3.3 The premises used in the December 2008 actuarial reappraisal for the 2009 fiscal year were approved by the Executive Board and by the Deliberative Body. The approved premises were:

3.3.4 When comparing the current premises to those of the previous year, we notice there were changes in those that regard wage capacity and the wage growth rate. The capacity factor was reduced from 98.053% to 97.972% because of the change in scenario for the long-term inflation rate.

3.3.5 The wage growth rate, which reflects the projection of the active participants’ wages when they start receiving the benefit, was changed from 3.3044% to 3.4337%, as per a report prepared by the sponsor.

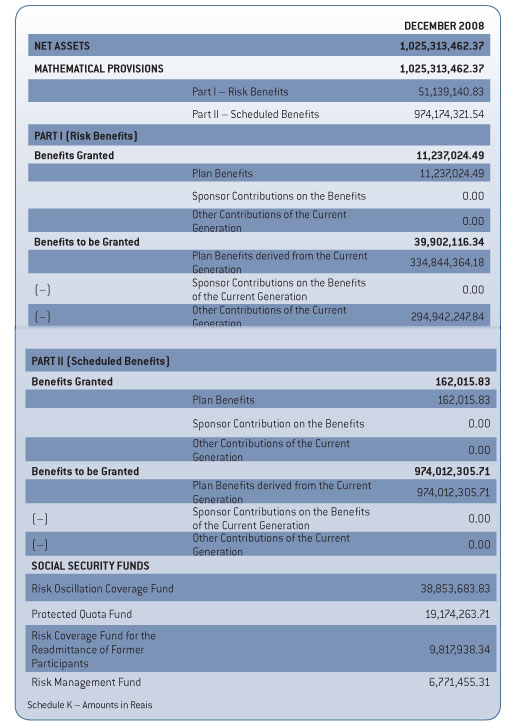

3.4 Financial and actuarial status3.4.1 The actuarial appraisal of the social security commitments taken-on by the plan on 12/31/2008 and of its Net Assets showed these results:

3.4.2 The following Social Security Funds were created in October 2006, after adjustments were made to processes and systems, and appropriate amounts were allocated to them:

-

• Protected Quota Fund: relative to resources that do not have destinations specified for them in the current regulation, e.g. for participants who left the Plan and are no longer hired by the Bank, remaining with the employer’s part relative to Part II of the Plan since there is no destination for them in the regulation in effect. There are also resources related to the redemption of personal contributions made by participants who left the Plan but remain hired by the Bank.

-

• Fund to Cover Risks for the Readmittance of Former Participants: relative to the amounts that are necessary to recompose the employer’s balance for Part II for participants who left the Plan, but remained hired and, thus, can return to it, with such right being acknowledged by the Plan’s regulation.

• Risk Management Fund: constituted to face commitment oscillations and operating adjustments made to the Plan. The balance of this fund was reduced by R$8,244,794.38 to cover the technical deficit calculated 12/31/2008.

3.4.3 There is also a Risk Oscillation Coverage Fund, constituted in December 2005 to be used whenever there is a reduction in the amount of the PREVI-PP part.

3.4.4 There was a significant variation in the technical result during the year on account of the negative performance of the Variable Income assets in late 2008. This had a negative impact on the technical result of Part I, and it was necessary to have a subsidy from the Risk Management Fund, as mentioned in item 3.4.2, to balance the Plan’s accumulated deficit in December 2008.

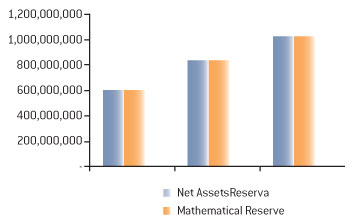

3.4.5 The following is the evolution of the Plan’s Mathematical Provisions and Net Assets in the past three years:

3.5.1 The Funding Plan determines the contribution level that is required to fund the plan’s benefits according to the financial system and the funding method in order to maintain the plan’s balance and solvency.

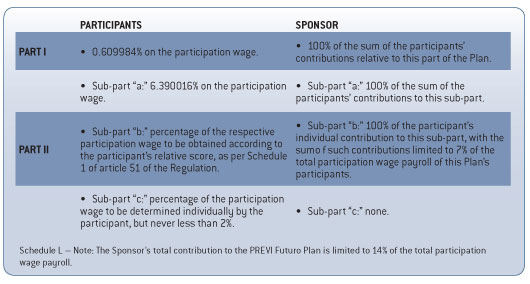

3.5.2 The PREVI Futuro Benefit Plan is funded by the monthly and annual contributions made by the participants and by the sponsor, as listed n Schedule L.

3.6.1 Before the reversal of the Risk Management Fund, the calculation of the Plan’s results on 12/31/2008 showed a technical deficit of R$8,244,794.38. Two factors greatly influenced result: the Plan’s -2.60% negative profitability variation in 2008, and wage increases above the projection made in December 2007, together with the increase in the wage increase premise, which went from 3.3044% to 3.4337%. Given the conjunctural nature of these factors, the balance of the Risk Management Fund was used to cover the technical deficit.

3.6.2 The number of assets appraised in the actuarial calculation rose from 43,624 (December/2007) to 50,376 (December/2008), a 15% increase derived from the significant amount of adhesions to the Plan by employees who were hired by Banco do Brasil during 2008. The inclusion of this new group of participants formed, on average, by young people with early career wages, had a positive impact on the Plan’s results.

3.7 Conclusion3.7.1 The results calculated for the Mathematical Reserves after the adjustments that were made to guarantee the coverage of the commitments the Plan took-on allowed the Plan’s technical balance to be reestablished.

3.7.2 We assessed the current Funding Plan Maintenance as satisfactory to preserve its balance in order to ensure the active participants of the PREVI Futuro Benefit Plan will have retirements with benefits compatible with their remuneration.

3.7.3 We suggest a study be carried out to reduce PREVI’S part in the 2009 fiscal year, using resources from the Risk Oscillation Coverage Fund to face possible actuarial liability increases.